-

3 Seater Royal Steel Sofa - Straight Model - Red Color

49505980 17% off -

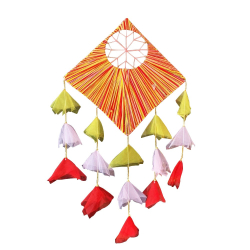

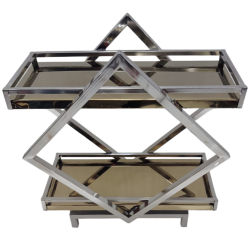

2 Step Patang Golden

34504180 17% off -

3 Step Patang Golden

40004850 18% off -

4 Step Zip Zag Katori Golden

46506000 23% off -

3 Step Stair Spun Golden

24503000 18% off -

2 Step Stair Spun Golden

21502600 17% off -

Artificial Flower Bouquet - multi colour

272350 22% off -

Artificial 2 Patti White Velvet Rose 7 Stick Bunch

100120 17% off -

Artificial 2 Patti Red Velvet Rose 7 Stick Bunch

100120 17% off -

Artificial 10 - Patti Small (Mums) 5 Stick Bunch

110120 8% off

-

Heart Shape Double Ring Stand - 4 FT - made Of Iron

23573500 33% off -

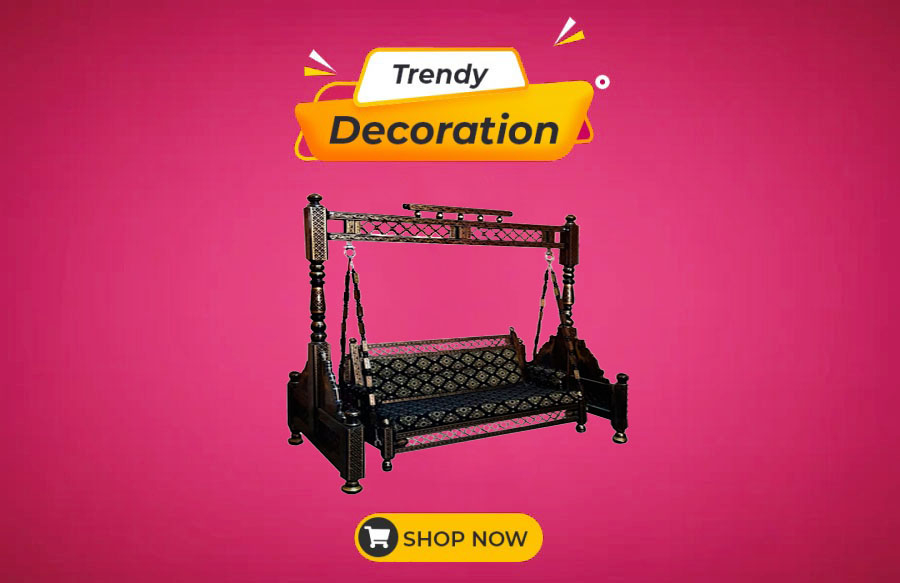

Moon Jhula Stand - Made Of Iron

64618400 23% off -

Round Chafing Dish with Lid - 7.5 LTR - Made of Stainle..

22755000 55% off -

Stage Decorative Rectangular Pannel - Made Of Polyeste..

30394144 27% off -

Dream Catcher Kite - 30 Inch - Made Of Woolen & Metal

136275 51% off -

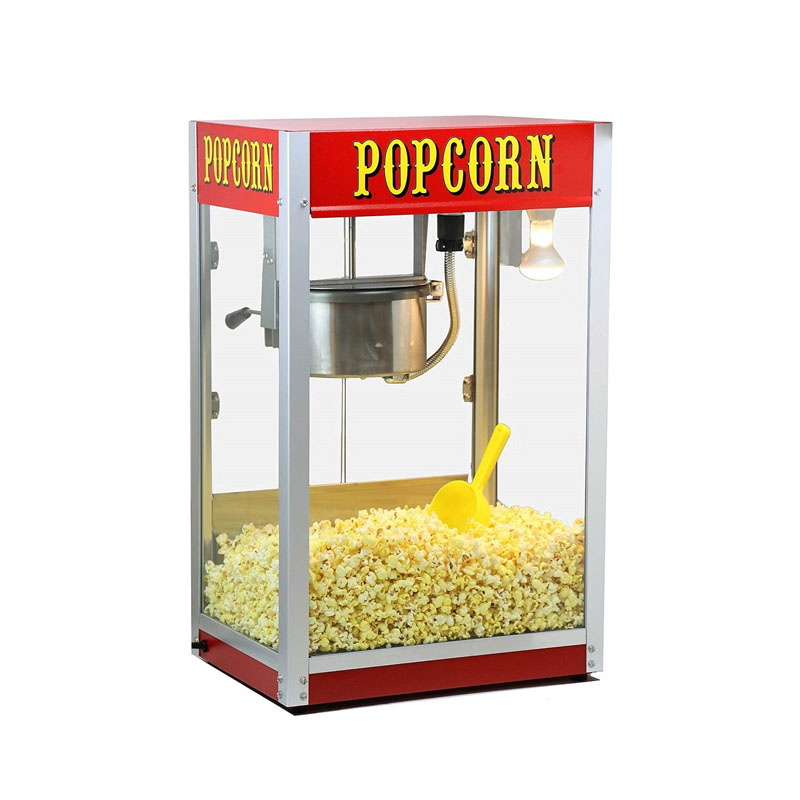

Podium with Mic - Made of Stainless Steel.

660210900 39% off -

Stage Decorative Rectangular Heart Shape Pannel ( Witho..

30394144 27% off -

Electric Soup Warmer Commercial Heater Kettle - 30.5 CM..

52577500 30% off -

Rectangular Table - 2 Ft - Made Of Wood & Iron

17412000 13% off -

Decorative Round Stage Pannel - Made Of Polyester

9511166.20 18% off